Saving for Retirement: Pre-Tax

Estimate Your Retirement Wealth and Reduce Taxes Early On with 401(k), 403(b) and Solo 401(k) Plans.

Summary

Pre-tax retirement savings plans like the 401(k), Solo 401(k), and 403(b) provide tax advantages and are tailored to different employment situations, helping individuals reduce taxable income and grow their retirement savings.

The 401(k) offers benefits such as tax savings, employer match contributions, and high contribution limits, making it ideal for traditional employees, while the Solo 401(k) provides flexibility and high contribution limits for self-employed individuals and small business owners.

The 403(b) plan, suitable for employees of public schools and certain non-profits, offers tax-deferred growth, potential employer contributions, and eligibility for additional catch-up contributions, emphasizing the importance of early and consistent savings for retirement.

We show that by saving as early as possible, you could generate millions when you retire that you could live on or pass onto beneficiaries in your estate.

Learn about Roth IRAs, Mega Backdoor Roth IRAs and Section 529 Plans in post-tax retirement strategies that could generate millions in tax-free retirement savings !

Disclaimer:

This post is for informational purposes only and does not constitute financial or investment advice. It is not intended to recommend any specific investment or provide a basis for making investment decisions. As the author, I am not a financial advisor, and my opinions should not be taken as financial advice. Investments carry risks and can fluctuate in value; past performance is not indicative of future results. Readers should conduct their own research or consult with a professional financial advisor before making any investment decisions. By reading this post, you agree that neither the author nor any affiliated entities shall be liable for any losses, damages, or claims that may arise from actions taken based on the information provided.

In the quest for a secure retirement, understanding the landscape of pre-tax savings plans is crucial. These vehicles offer tax advantages that can significantly bolster your retirement savings over time. Below, we explore a variety of pre-tax plans, including the popular 401(k), Solo 401(k), and 403(b) plans, among others. Whether you're an employee, self-employed, or a small business owner, there's a plan tailored to your financial situation and retirement goals.

1. 401(k) Plans

The 401(k) plan is one of the most popular retirement savings vehicles in the United States, offered by employers to their employees. It allows you to contribute a portion of your pre-tax salary, which means taxes on these contributions and their investment earnings are deferred until you withdraw the funds in retirement.

Benefits:

Tax Savings: Contributions reduce your taxable income for the year, potentially lowering your tax bill.

Employer Match: Many employers offer a matching contribution up to a certain percentage of your salary, which is essentially free money.

High Contribution Limits: For 2024, the contribution limit is $23,000, with an additional catch-up contribution of $7,500 for those aged 50 and older.

Estate Planning Advantages: Named beneficiaries can inherit remaining funds.

Start as Early as Possible. You could have up to $5 million to tap at retirement.

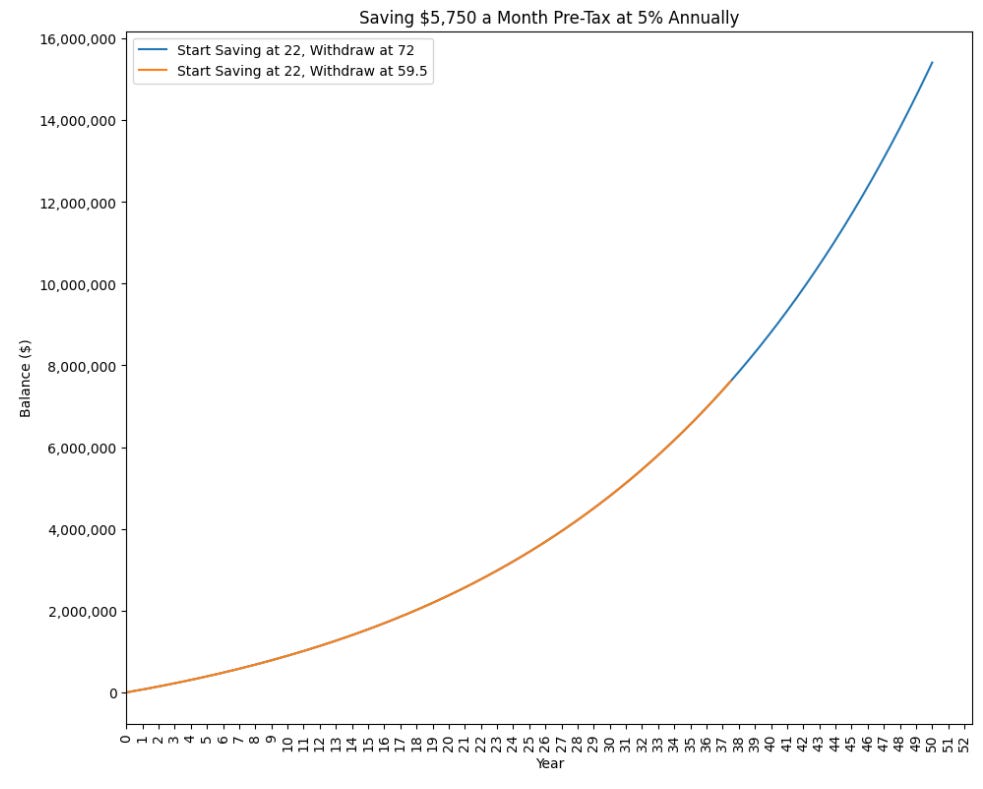

To see this, let’s use our savings calculator with the below assumptions:

You max out your annual contributions each year. The limits usually increase year-over-year, but let’s assume it’s $23,000 for this simulation.

They grow at 5% annually, compounded monthly.

No employer match (for simplicity - it’s different for different employers).

You do this from ages 22 - 59.5 or 72 (when the IRS allows and requires withdrawals, respectively).

Below is how your savings could grow.

It could be up to $2.5 million if you decided to withdraw at 59.5,

It could be up to $5 million if you decided to wait until 72.

Not only is this great income to live on or pass onto your beneficiaries in your estate, but you could get deductions to lower your taxable income each year.

Sign-up for sessions at Quant Coaching today to learn more.

2. Solo 401(k) Plans

The Solo 401(k) plan, also known as the Individual 401(k), is designed for self-employed individuals or small business owners with no employees other than a spouse. This plan offers similar benefits to a standard 401(k) but is tailored to fit the unique needs of entrepreneurs and freelancers.

Benefits:

Tax Savings: Contributions are made pre-tax, thereby reducing your taxable income. This can be particularly advantageous for self-employed individuals looking to maximize their retirement savings while minimizing tax liability.

Flexibility: You can contribute both as an employee and as an employer, significantly increasing the potential contribution amount.

High Contribution Limits: The total contribution limit is up to $69,000 for 2024, with an additional $7,500 catch-up contribution for those 50 and older.

Estate Planning Advantages: Named beneficiaries can inherit remaining funds.

Since the contribution limit here is higher than the 401(k) - you could still use the earlier simulation to determine how much you would have at retirement.

Let’s just run a simulation to see what would happen if you maxed it out at $69,000 a year.

Below is how your savings could grow.

It could be up to $7.5 million if you decided to withdraw at 59.5,

It could be up to $15 million if you decided to wait until 72.

Not only is this great income to live on or pass onto your beneficiaries in your estate, but you could get deductions to lower your taxable income each year.

Sign-up for sessions at Quant Coaching today to learn more.

3. 403(b) Plans

The 403(b) plan is similar to the 401(k) but is specifically offered by public schools and certain tax-exempt organizations. It's an excellent option for teachers, professors, and employees of non-profits.

Benefits:

Tax-Deferred Growth: Like the 401(k), contributions to a 403(b) plan are made pre-tax, reducing taxable income.

Employer Contributions: Employers can contribute to your 403(b) plan, often matching your contributions up to a certain limit.

Eligibility for Additional Catch-Up Contributions: Employees with 15 or more years of service may be eligible for additional catch-up contributions, beyond the standard catch-up limits.

Since this is basically just a 401(k) plan designed for special institutions, the same simulation to estimate how much you’d have at retirement holds (below).

How to Choose the Right Plan

Choosing the right pre-tax retirement plan depends on your employment status, income level, and retirement goals. If you're traditionally employed, a 401(k) with an employer match is a no-brainer due to the matching contributions. For the self-employed or small business owners, a Solo 401(k) offers high contribution limits and flexibility. And if you're working for a public school or a non-profit, a 403(b) can offer unique benefits tailored to your sector.

Regardless of the plan you choose, the key is to start saving early and consistently. Time is one of the most critical factors in building your retirement nest egg, thanks to the power of compound interest. Additionally, consider consulting with a financial advisor to tailor your retirement strategy to your specific situation, ensuring you maximize your savings and tax advantages.

In conclusion, pre-tax retirement plans offer a valuable opportunity to save for your future while reducing your current tax liability. Whether you opt for a 401(k), Solo 401(k), or 403(b), the most important step is to begin contributing as soon as possible. With careful planning and disciplined saving, you can build a robust financial foundation for your retirement years.

Sign-up for sessions at Quant Coaching today to learn more about investing.